Supply Chain Finance Solution

Buy and Sell Cryptocurrencies Safely all over the world which holds a VASP license granted by the Europe

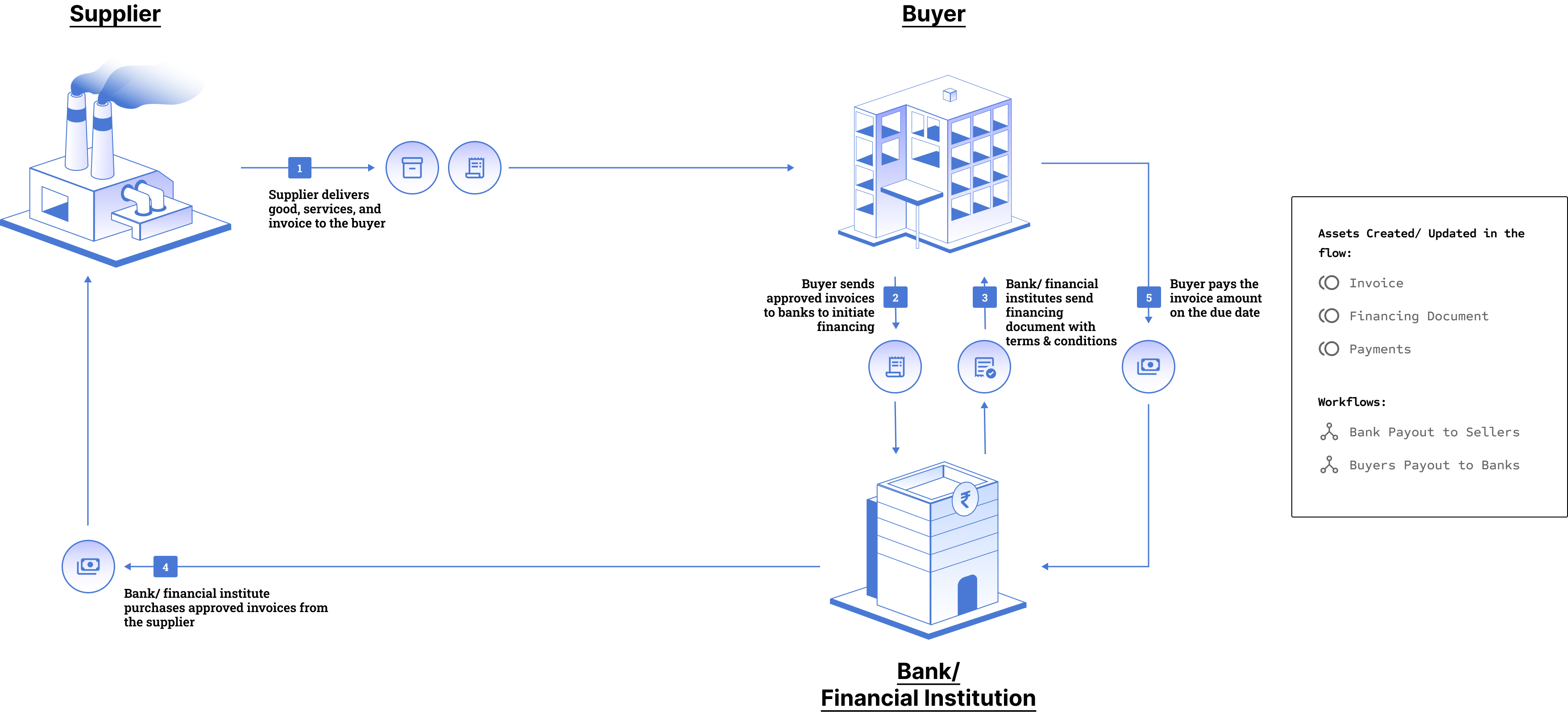

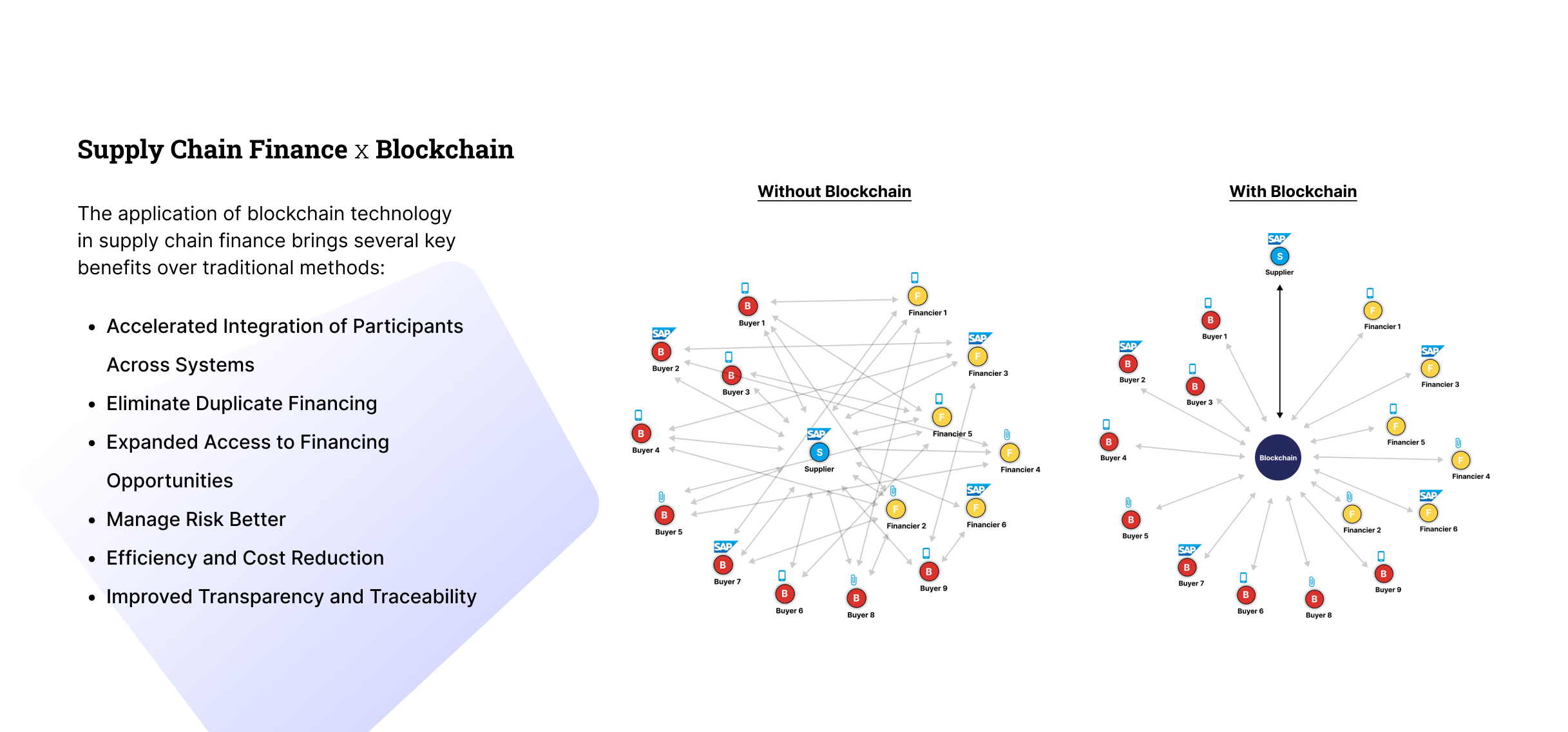

Several industries can benefit from implementing supply chain finance on blockchain due to the technology ability to enhance transparency, efficiency, and trust in supply chain transactions. Blockchain helps pharmaceutical companies combat counterfeit drugs, supply chain inefficiencies, and regulatory compliance challenges. It enables tracking and authentication of drugs throughout the supply chain, ensuring product integrity and regulatory compliance. Supply chain finance on blockchain improves cash flow and supplier payment management. Manufacturers benefit from blockchain-based supply chain finance by optimizing working capital, streamlining supplier payments, and improving inventory management. Enhanced transparency and traceability ensure the authenticity and quality of raw materials and components. Retailers leverage blockchain for improved visibility into supply chains, tracking goods from suppliers to stores and ensuring product authenticity. Blockchain-based supply chain finance optimizes cash flow and offers financing options to suppliers, enhancing supply chain resilience. Blockchain enhances traceability and food safety in the food and agriculture industry. Stakeholders can track food products from farm to fork, enabling quicker recalls and reducing foodborne illness risks. Supply chain finance on blockchain facilitates financing for farmers and producers based on transaction transparency. The logistics and transportation industry benefits from blockchain-based supply chain finance for cash flow management and operational optimization. Blockchain enhances transparency by providing real-time visibility into goods movement and automating documentation and compliance processes. Supply chain finance on blockchain enables access to financing based on transaction transparency and reliability. Various participants play distinct roles in the ecosystem. Each participant of the supply chain stands to gain specific benefits from utilizing blockchain technology

Benefiting Industries

Benefits for Participants

Buy and Sell Cryptocurrencies Safely all over the world which holds a VASP license granted by the Europe.